Uncertainty – a common theme in Business Today

Uncertainty – a common theme in Business Today

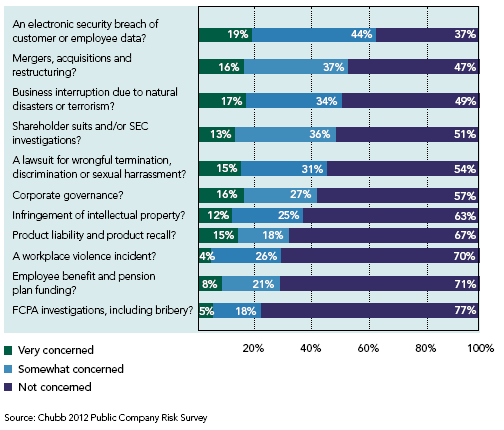

| From a 2012 Chubb Public Company Risk Survey todays publicly traded companies are most concerned about cyber issues, mergers and acquisitions, business interruptions and shareholder suits/SEC investigations. They are less concerned with employee benefit and pension plan funding, workplace violence and product liability issues. |

Key findings from Chubb’s survey:

- About D&O Liability:

- Financial strength is the leading criteria in selecting a carrier for primary D&O liability insurance and fiduciary liability insurance.

- About 2 in 3 public companies consult the board when purchasing primary D&O liability insurance, but the board is the leading purchase decision maker in only a handful of companies.

- Potentially big risk areas:

- About 2 in 3 public companies (64%) still do not purchase cyber insurance.

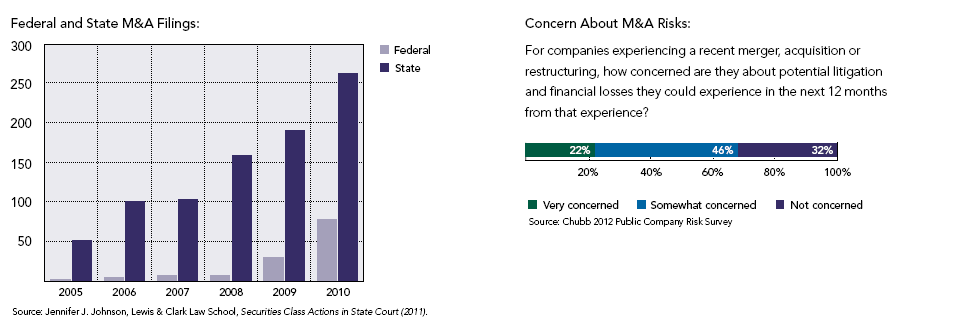

- Nearly 2/3 of the companies were involved in a merger or acquisition in the past two years – an activity that nearly always creates D&O liability exposures, as well as fiduciary liability and employee fraud risks.

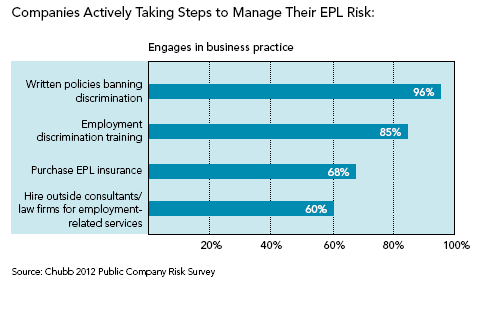

- A large number (42%) of companies actually experienced an EPL event in the past two years, and most – but not all – have taken steps to handle their EPL exposures through insurance and other risk management measures.

- Preparing for risk:

- Over the past year, almost all areas of risk saw a net increase in resources allocated to risk mitigation. The biggest increases were allocated for mitigating risks from electronic security breaches, corporate governance, and financial and disclosure controls.

- Global companies are more apt to purchase a locally admitted policy for D&O liability than for employment practices liability, fiduciary liability or crime.

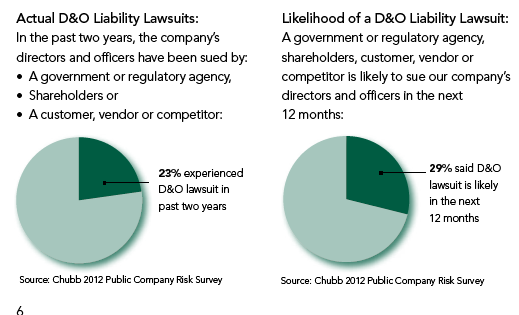

Directors & Officers Liability

The risk of D&O lawsuit is rising:

Mergers and Acquisitions

Mergers and Acquisitions related litigation is shockingly common.

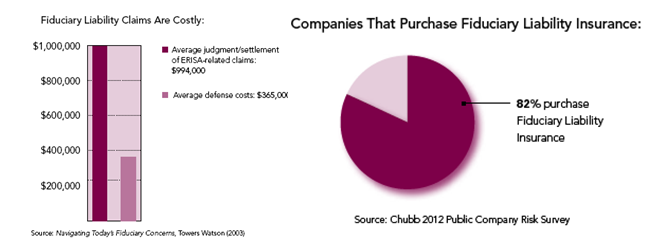

Fiduciary Liability

If a company provides employee benefit plans, such as health and retirement plans, then the company and its plan fiduciaries are potential targets for breach of fiduciary duty lawsuits.

Most companies are not concerned about Fiduciary Liability risk. Only about quarters (29%) of respondents are concerned about potential litigation and financial losses over the next 12 months from employee benefit and pension plan funding. This is despite the fact that Fiduciary Liability claims are very costly.

Cyber Risks

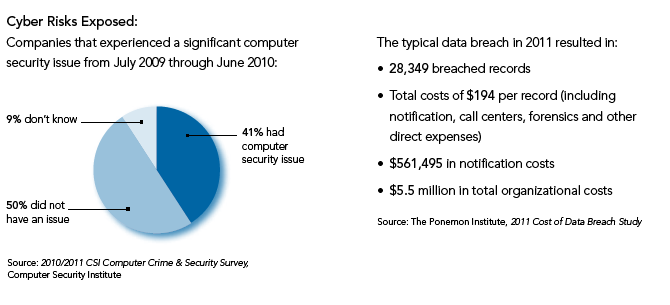

Slowly concerns are growing over cyber risk, but not keeping pace with the potential liability. In the Chubb survey respondents identified cyber risk as their #1 concern from a list of exposures, but insurance purchases lag. Nearly 2 in 3 public companies (64%) still do not purchase cyber insurance, but 63% say they are concerned about cyber risk.

Employment Practices Liability (EPL)

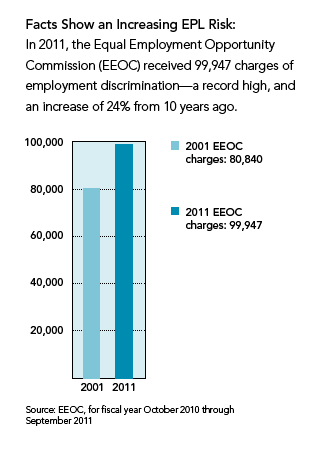

EPL is among the most common lawsuits companies face with median awards topping $200,000 in 2010 (according to Jury Verdict Research). 42% of the companies surveyed were targets of employment related lawsuit or EEOC discrimination complaint over the past two years.

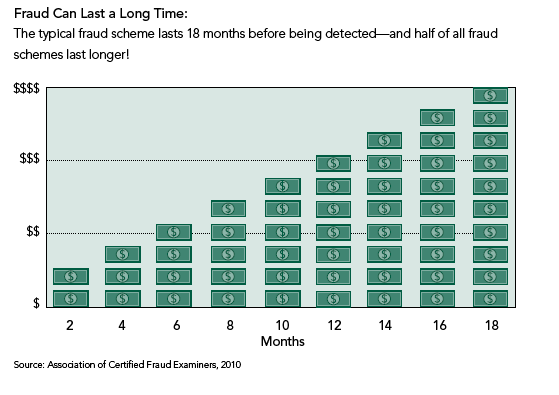

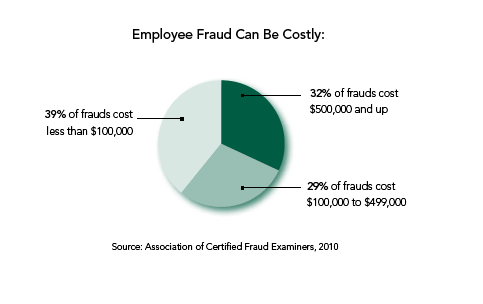

Employee Fraud

Employee Fraud is a well-documented exposure and even companies with the best financial controls are not immune. On average 5% of a company’s annual revenues are lost to employee fraud and more than half result in losses of more than $100,000. Smaller companies are typically more vulnerable to fraud than larger ones and it has a higher impact on their bottom line.

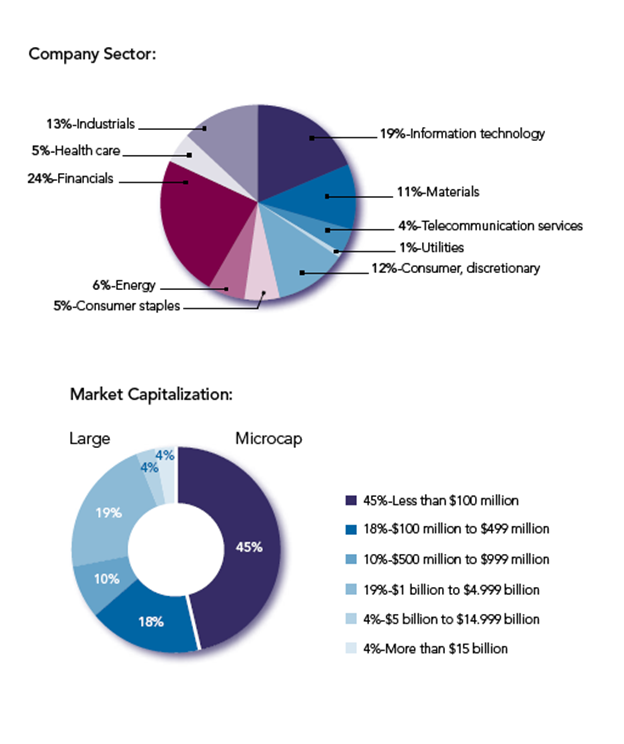

Breakdown of Profile Participants

The entire survey from Chubb – Chubb Public Company Survey 2012

This document is advisory in nature, it is offered as a resource to be used together with your professional insurance advisers in maintaining loss prevention program. The information provided should not be relied on as legal or insurance advice or a definitive statement of the law in any jurisdiction. For such advice, an applicant, insured. Listener or reader should consult their own legal counsel or insurance consultant. No liability is assumed by reason of the information this document contains.